Peppol E-Invoicing Revolution in Belgium: Why 2026 Changes Everything for Construction Companies

From January 1, 2026, Peppol e-invoices are mandatory in Belgium. Learn the system, deadlines, and practical steps for your construction business.

admin

January 04, 2026

⚠️ Most Important Information

From January 1, 2026, all B2B invoices in Belgium must be issued via the Peppol network. PDF, Excel, and paper invoices will cease to be legally compliant in business-to-business transactions.

Imagine this scenario: You run a medium-sized construction company in Ghent, undertaking several renovation projects in Flanders. Every month, you send 50-100 invoices via email, manually track payments, and spend hours reconciling accounts. From January 2026, each of these invoices must pass through a standardized digital channel, formatted in Peppol BIS 3.0, containing specific mandatory fields, and delivered directly to your client’s Peppol inbox.

This is not merely a technical update – it is a complete redesign of how businesses in Belgium exchange commercial documents.

Why is Belgium Introducing These Changes?

European Context

Belgium’s move towards mandatory Peppol e-invoicing is not happening in isolation. The European Union has been promoting standardized electronic invoices for over a decade, but recent developments have dramatically accelerated the timeline.

In April 2024, the EU adopted Directive 2024/825, mandating all member states to implement e-invoicing for B2B transactions. Belgium has opted for an earlier implementation than many other EU countries.

Fighting VAT Fraud

Beyond European harmonization, Belgium has a compelling domestic reason to adopt e-invoicing: VAT compliance and fraud prevention. The construction sector has long been plagued by VAT carousels and “under-the-table” payments, costing the Belgian government an estimated €500 million to €1 billion annually in lost tax revenue.

How Does Fraud Work in the Traditional System?

A contractor issues an invoice, charges VAT, but never remits it to the tax authorities. The recipient deducts the VAT as input tax, creating a discrepancy that tax authorities struggle to detect, especially when multiple companies are involved in the chain.

E-invoicing fundamentally changes this landscape. With every invoice required to be in a standardized format and transmitted through a registered network like Peppol, tax authorities gain unprecedented insight into transaction chains. The Belgian tax administration (FOD Financiën) will be able to cross-reference issued invoices with received invoices in real-time.

Modernizing the Economy

According to European Commission estimates, the average SME in the EU spends 2-5% of its revenue on administrative tasks related to invoicing. For a construction company with €5 million in annual revenue, this could mean €100,000 to €250,000 annually spent on paperwork.

The Belgian government estimates that the full adoption of e-invoicing could save the national economy €2.3 billion annually in administrative costs.

What is Peppol and How Does It Work?

Peppol Network Explained

Peppol (Pan-European Public Procurement OnLine) is an international network for the secure exchange of electronic business documents. Think of it as a “SWIFT network for invoices” – a standardized infrastructure that allows businesses to send and receive documents in a common format, regardless of the accounting software they use locally.

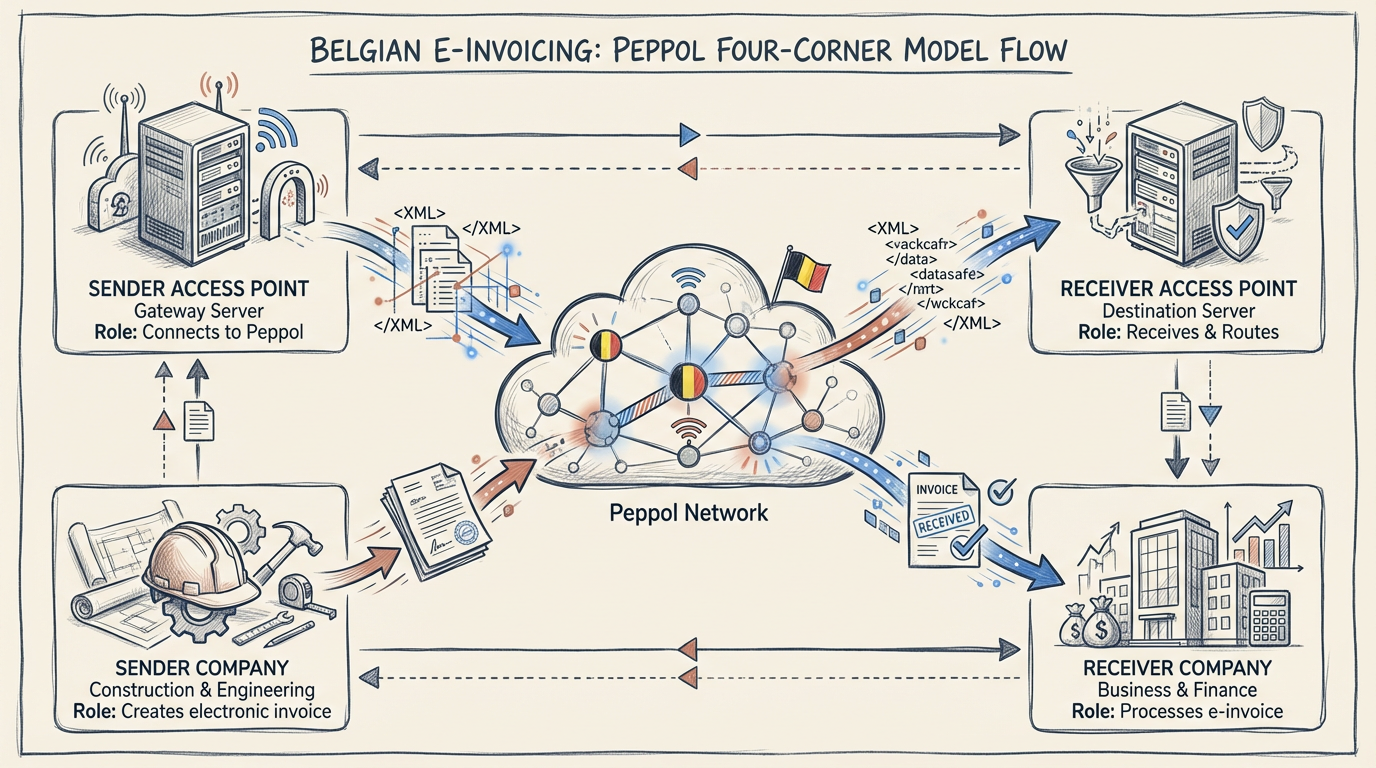

The Four-Corner Model

The Peppol network operates on a four-corner model:

| Participant | Role | Example |

|---|---|---|

| 1. Sender | Your company generates an invoice in Peppol BIS 3.0 format | BuildHub AI creates an invoice |

| 2. Sender's Access Point | Peppol service provider, gateway to the network | e.g., Qvalia, Pagero, Tradeshift |

| 3. Receiver's Access Point | Access Point corresponding to the client's Peppol ID | Your client's Access Point |

| 4. Receiver | Client's software receives and processes the invoice | Client's accounting system |

This architecture ensures that companies using vastly different software – from Sage to SAP to in-house solutions – can exchange invoices seamlessly.

Technical Standard: Peppol BIS 3.0

When Belgium mandates Peppol e-invoicing, it specifically requires the Peppol BIS (Business Interoperability Specification) Billing 3.0 format. This is crucial: it’s not just about sending invoices electronically – it’s about sending them in a specific, standardized format.

Peppol BIS 3.0 is based on UBL 2.1 (Universal Business Language), an international standard for business documents. For a construction contractor, this means the invoice must contain specific data elements in defined formats:

| Element | Requirement |

|---|---|

| Seller Identification | Company Name, VAT Number, Peppol ID |

| Buyer Identification | Company Name, VAT Number, Peppol ID |

| Invoice Number and Date | Required |

| Line Items | Description of work, quantities, prices |

| VAT Breakdown | By rates (21%, 6%, 0%, reverse charge) |

| Totals | Net, VAT, Gross |

For construction invoices, particularly important are: the site address, service completion dates, and appropriate markings for reverse charge scenarios (BTW verlegd).

Why is This Especially Important for Construction Companies?

The Industry’s Unique Position

The construction industry faces distinct challenges and opportunities in transitioning to Peppol e-invoicing.

Consider a typical construction project in Belgium: A general contractor wins a contract to renovate a residential property built in 1975. The project involves demolition, electrical work, plumbing, plastering, and the installation of a new heating system. The total contract value is €120,000, phased over six months.

Under the current system, the contractor issues phased invoices with varying VAT treatments: demolition and reconstruction work may qualify for 6% VAT (assuming the property meets the 10-year requirement), while the installation of the heating system might be subject to the standard 21% rate (especially after the July 2025 regulatory change excluding fossil fuel boilers from the reduced rate).

💡 Key Benefit of Peppol

The standardized format enforces precise specification of VAT rates, work descriptions, and other elements. This precision reduces errors and audit risks, but also requires contractors to adopt a more systematic approach to structuring invoices.

Faster Payments and Improved Cash Flow

One of the most tangible benefits for contractors is the potential for faster payment cycles. Construction companies have historically struggled with slow payments – projects finish, invoices go out, and payment arrives weeks or months later.

Peppol e-invoicing accelerates payments in several ways:

| Aspect | Traditionally | With Peppol |

|---|---|---|

| Delivery | Days (email, post) | Seconds |

| Validation | Manual, days | Automated, minutes |

| Disputes | Frequent (unclear data) | Rare (standardization) |

| Accounting | Manual entry | Automated |

For a construction company issuing €500,000 in invoices monthly, even a 5-day reduction in average payment time means approximately €68,000 in freed-up working capital annually (at a 5% financing cost).

Reduced Risk of Errors and Penalties

Complex VAT rules in construction create significant compliance risks. Applying the wrong rate, omitting a required clause, or improperly documenting reverse charge conditions can lead to penalties, post-audit adjustments, or denial of input VAT deduction.

Consider the consequences of a VAT error on a €100,000 invoice:

| Type of Error | Consequence |

|---|---|

| Undercharged VAT | Loss of up to €21,000 revenue + penalties up to 200% |

| Overcharged VAT | Invoice rejection, delays, corrections |

| Incorrect Reverse Charge | Compliance issues for both parties |

Practical Examples for Contractors

Example 1: Renovation Contractor with Mixed VAT Rates

You run a renovation company in Antwerp and have just completed work on a residential property built in 1965 (well above the 10-year threshold). The project included:

- Kitchen renovation: €25,000

- Bathroom renovation: €18,000

- Installation of a new gas boiler: €8,000

According to Belgian VAT regulations, kitchen and bathroom work qualify for the reduced 6% rate. However, the boiler installation – as a fossil fuel heating system – does not qualify for 6% after the July 2025 regulatory change. It must be charged at the 21% rate.

| Description | Net Amount | VAT Rate | VAT Amount |

|---|---|---|---|

| Kitchen Renovation | €25,000 | 6% | €1,500 |

| Bathroom Renovation | €18,000 | 6% | €1,080 |

| Gas Boiler Installation | €8,000 | 21% | €1,680 |

| TOTAL | €51,000 | — | €4,260 |

The invoice must also include the required presumption clause for the 6% rate: a statement that if the client does not object in writing within one month, they acknowledge the property meets the requirements for the reduced rate.

Example 2: General Contractor with Subcontractors

You are managing the construction of a new commercial office building in Ghent. You have engaged three subcontractors:

| Subcontractor | Value | VAT Mechanism |

|---|---|---|

| Electrical Work | €75,000 | Reverse Charge (BTW verlegd) |

| HVAC Installation | €120,000 | Reverse Charge (BTW verlegd) |

| Steel Structure | €200,000 | Standard 21% VAT (new construction) |

The electrical and HVAC subcontractors invoice you under the reverse charge mechanism. Their invoices must include the extended BTW verlegd clause – a significantly longer text required since November 2022, not the old short designation.

When you receive these invoices via Peppol, your system validates that they contain the correct clause and the appropriate reverse charge marking.

Timeline and Deadlines

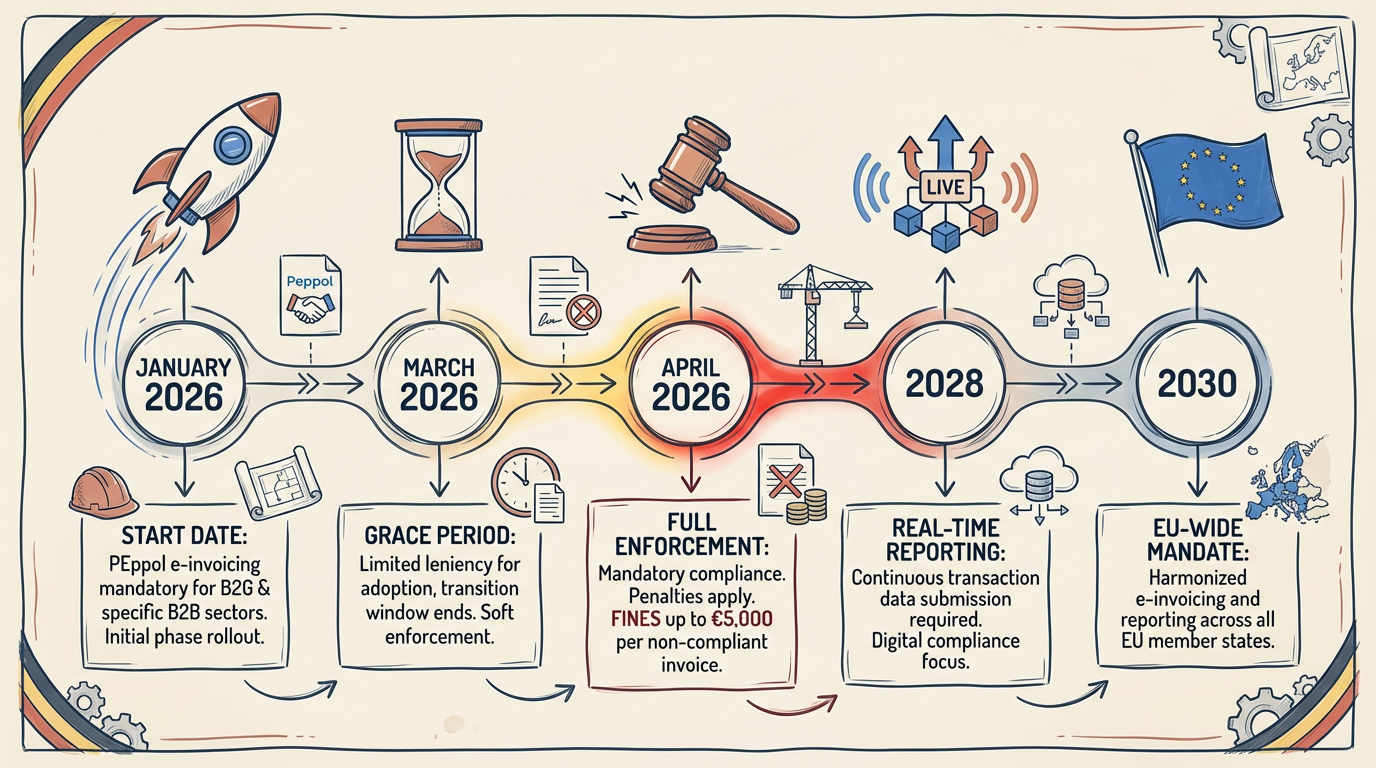

| Milestone | Date | What it Means |

|---|---|---|

| 🚀 B2B Mandate Start | January 1, 2026 | All B2B invoices must use Peppol BIS 3.0 format |

| ⏳ Transition Period | January 1 - March 31, 2026 | No penalties if good faith effort to comply is shown |

| ⚖️ Full Enforcement | April 1, 2026 | Fines: €1,500 (I), €3,000 (II), €5,000 (subsequent) |

| 📊 Real-time e-reporting | January 1, 2028 | Tax authorities receive data in near real-time |

| 🇪🇺 EU Cross-border Mandate | 2030 | Mandatory e-invoicing across all EU countries |

6 Steps to Prepare Your Business

Step 1: Obtain a Peppol ID

Your company needs a Peppol identifier in the format: BE + VAT number (e.g., BE0123456789). Many service providers will assist you in obtaining and registering this ID.

Step 2: Choose an Access Point Provider

Select a Peppol Service Provider that fits your needs and budget. Consider:

- Integration capabilities with your existing software

- Pricing model (per transaction vs. subscription)

- Quality of customer support

- Additional features (validation, archiving)

Step 3: Update Your Accounting Software

Ensure your invoicing software can generate documents compliant with Peppol BIS 3.0. If your current software does not support this, you will need to upgrade it, add a module, or consider alternative solutions.

Step 4: Train Your Team

Your accounts receivable department must understand the new requirements: how to generate invoices correctly, what information must be included, and how to handle VAT rate selections for different transaction types.

Step 5: Inform Your Clients

Notify your clients about the transition to Peppol e-invoicing. Share your Peppol ID so they can configure their systems to receive your invoices. Many larger clients are already asking their suppliers about Peppol readiness – be proactive.

Step 6: Test Extensively

Before January 1, 2026, conduct test transactions with willing clients and your Access Point provider. Verify that invoices are generated correctly, delivered successfully, and received by client systems.

How BuildHub AI Can Help with the Peppol Transition

BuildHub AI is designed with the specifics of the Belgian construction market in mind and offers comprehensive support for Peppol e-invoicing:

BuildHub AI is actively developing functionalities to support the transition to Peppol e-invoicing. Our team is working on integrations that will simplify compliance for construction companies, from generating invoices in the correct format to automated data validation.

Want to stay updated on new features? Sign up for a demo account and receive notifications about updates.

Conclusion

The transition to mandatory Peppol e-invoicing in Belgium is not a matter of “if,” but “how well.” The January 1, 2026 deadline is set. The penalties for non-compliance are real. The benefits for companies that get it right are substantial.

For construction contractors, this transformation intersects with an industry already facing significant pressures: labor shortages, rising material costs, regulatory complexity, and increasingly demanding clients.

But shifting perspective reveals an opportunity. E-invoicing is not just a compliance requirement – it’s an infrastructure for a more efficient, transparent, and competitive construction industry. Faster payments, lower administrative costs, reduced error rates, stronger audit trails, and improved relationships with larger clients are all within reach for companies that approach this transition strategically.

Prepare for Change with BuildHub AI

Test our tool and see how it can streamline documentation management for your construction business.

Try the Demo →This article is for informational purposes and reflects the regulatory landscape as of January 2026. Contractors should consult their tax advisors and software providers for specific implementation guidance.

Related Articles

VAT in Belgian Construction 2025-2026: Complete Guide to New Regulations

New Belgian VAT rules from July 2025: 21% on fossil fuel boilers, 6% on heat pu…

2026: E-Invoicing Revolution in Belgium and AI in Construction

Starting January 1, 2026, Belgian companies will only be able to send electroni…

AI in Construction 2025: Trend or Revolution?

AI is transforming construction: from smart cost estimates to automatic plannin…

Ready to optimize your construction business?

Join hundreds of construction companies using BuildHub AI