VAT in Belgian Construction 2025-2026: Complete Guide to New Regulations

New Belgian VAT rules from July 2025: 21% on fossil fuel boilers, 6% on heat pumps and renovations. Learn the changes and mandatory e-invoicing.

admin

January 04, 2026

📅 Key Dates 2025-2026

| July 1, 2025 | Fossil fuel boilers → 21% VAT |

| July 1, 2025 | New demolition/reconstruction system for all of Belgium |

| January 1, 2026 | Mandatory B2B e-invoicing via Peppol |

| March 31, 2026 | End of the transition period for e-invoices |

The construction industry in Belgium is currently undergoing some of the most significant tax changes in years. As of July 2025, new VAT regulations have come into effect, directly impacting how construction services are invoiced. If you run a renovation, development, or installation company, you must be aware of these changes – otherwise, you risk fines up to 200% of the due tax amount.

In this article, we explain the most important changes and show you how BuildHub AI can help you meet the new requirements without unnecessary stress.

6% VAT Rate on Renovations – Still Applicable, but with New Rules

Good news for companies involved in residential building renovations: the reduced VAT rate of 6% remains in effect. However, significant changes regarding its application have been introduced as of July 1, 2025.

Conditions for Applying 6% VAT

| Requirement | Details |

|---|---|

| Building Age | First occupancy at least 10 years ago |

| Purpose | Minimum 51% of the area for private residential use |

| Work Execution | Materials must be supplied AND installed by the contractor |

| Documentation | Declaration on the invoice regarding the conditions for 6% VAT |

Important: Since July 1, 2022, every invoice issued with the 6% rate must include a special declaration informing the client about the conditions for applying the reduced rate. The client has one month to submit a written objection – if no objection is received, their consent to your billing is assumed.

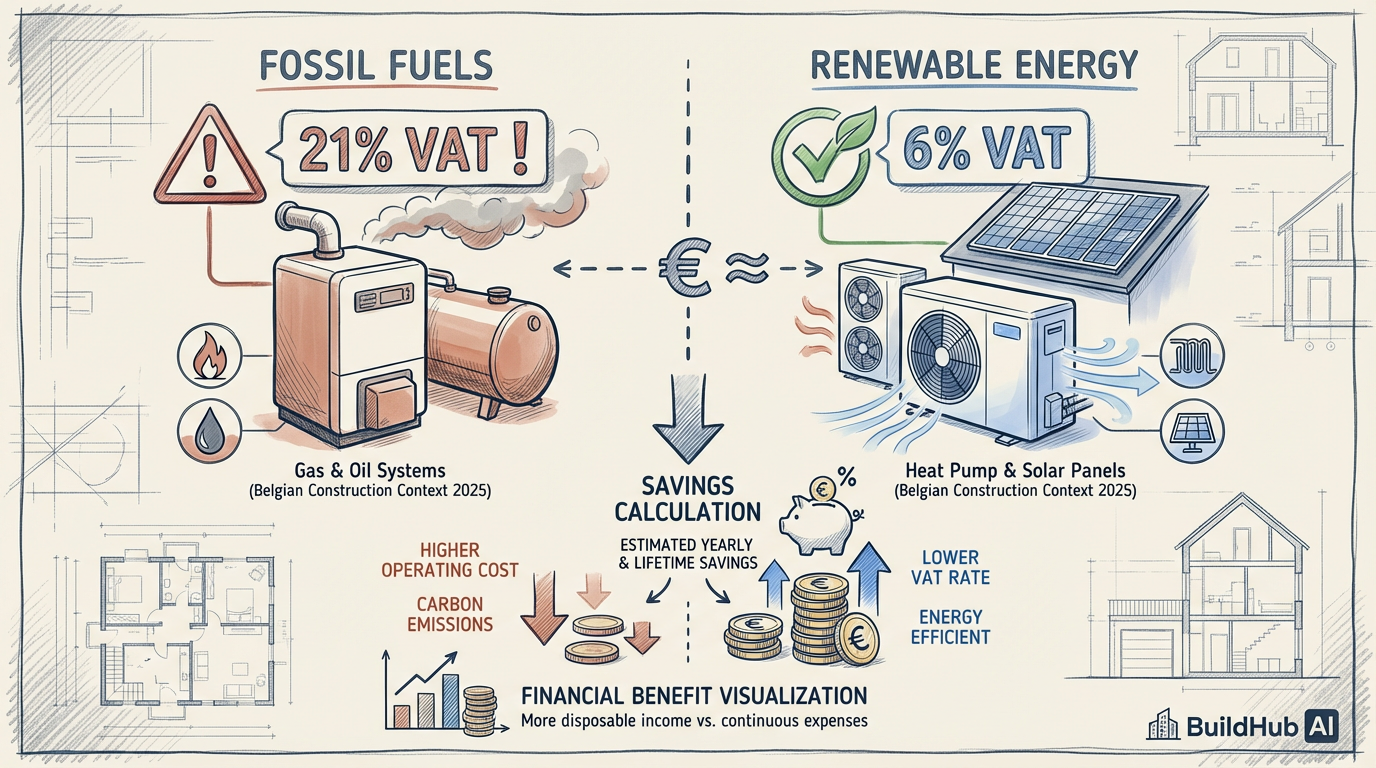

Fossil Fuel Boilers vs. Heat Pumps – A Key Change

This is one of the most controversial changes that will affect many installation companies. The table below shows the differences:

| Type of Installation | VAT until 06/30/2025 | VAT from 07/01/2025 | Difference for the client* |

|---|---|---|---|

| 🔥 Gas Boiler | 6% | 21% | +€1,200 |

| 🛢️ Oil Boiler | 6% | 21% | +€1,500 |

| ♻️ Heat Pump | 6% | 6% | €0 |

| ☀️ Solar Panels | 6% | 6% | €0 |

* Based on a net installation value of €8,000

Transitional Provision for Boilers

If you signed a contract with a client before July 28, 2025, and manage to issue an invoice by the end of June 2026, you can still apply the 6% rate. This is why archiving all contracts with their dates is so crucial!

💡 Practical Tip

Archive all client agreements along with their signing dates. This will allow you to prove your right to apply the preferential VAT rate during the transitional period.

Demolition and Reconstruction – A New System for All of Belgium

Until the end of June 2025, the preferential 6% rate for demolition and reconstruction projects was applicable only in 32 cities. As of July 1, 2025, the system covers all of Belgium, but new limitations have been introduced:

New Surface Area Limits

| Type of Transaction | Limit until 06/30/2025 | Limit from 07/01/2025 |

|---|---|---|

| Sale of Reconstructed Property | 200 m² | 175 m² |

| Construction Works Covered by 6% | 200 m² | 200 m² (no change) |

Three Settlement Paths

| Path | Requirements | Surface Area Limit | MyMinfin Form |

|---|---|---|---|

| Owner-Occupier | Registration immediately after completion, minimum 5 years of use | 200 m² | Yes |

| Social Rental | 15 years of social rental | No limit | Yes |

| Private Rental | 15 years of private rental | 200 m² | Yes |

Important: The MyMinfin declaration number must be submitted before commencing work!

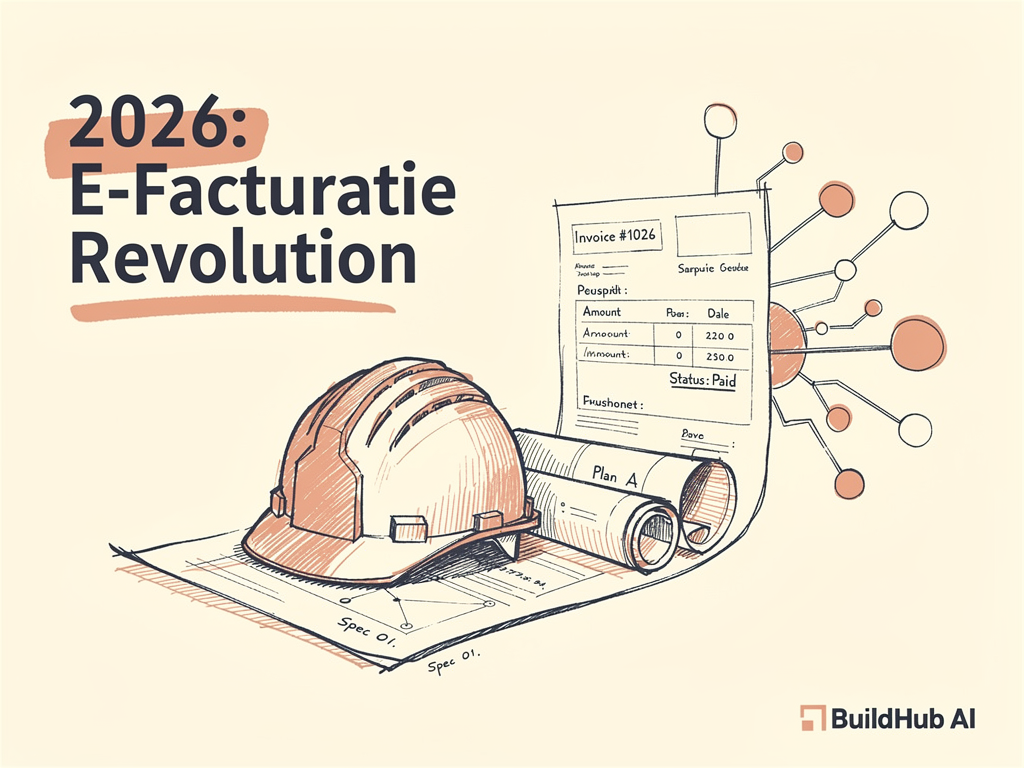

Peppol E-invoicing from January 2026

From January 1, 2026, every company in Belgium issuing B2B invoices must use the Peppol BIS 3.0 format. This is not an option – it is a legal obligation.

What Does This Mean in Practice?

- ❌ PDF, Excel, paper invoices do not meet the requirements

- ✅ XML format compliant with the Peppol standard is required

- ✅ Each item on the invoice must have a VAT category code

- ✅ Automatic exchange via the Peppol network

Implementation Schedule

| Date | What Happens |

|---|---|

| January 1, 2026 | Start of mandatory B2B e-invoicing |

| January 1 - March 31, 2026 | Transition period (no penalties for good faith) |

| April 1, 2026 | Full enforcement with penalties |

| January 1, 2028 | Real-time e-reporting to tax authorities |

How BuildHub AI Can Help You Meet New Requirements

In the face of so many changes, having the right invoice management tool is no longer a luxury – it’s an absolute necessity.

BuildHub AI is a tool designed for construction companies operating in the Belgian market. We are developing features to help manage complex VAT requirements and prepare for upcoming e-invoicing changes.

Want to check current capabilities? Try the demo account and see how BuildHub AI can support your business.

FAQ – Frequently Asked Questions

Can I still invoice a gas boiler at a 6% rate?

Yes, but only if the contract was signed before July 28, 2025, and the invoice is issued by June 30, 2026. After this date, the 21% rate applies without exceptions.

What if I am renovating an 8-year-old building?

Unfortunately, the building must be at least 10 years old from its first occupancy. For younger buildings, the standard 21% VAT rate on construction work applies.

What are the penalties for incorrect VAT rate application?

Penalties can reach up to 200% of the due tax amount, plus interest and legal costs. For a €10,000 invoice with an incorrectly applied rate, this could mean a penalty of over €3,000.

Do I need to prepare for Peppol now?

Absolutely! There is less than a year until January 1, 2026. Choose an Access Point provider, obtain your Peppol ID (format: BE + VAT number), and test the system before the deadline.

Summary

The new VAT regulations in Belgian construction may seem complex, but they represent an opportunity for companies that can adapt. Clients are increasingly looking for contractors who manage their documentation professionally and do not surprise them with hidden costs.

Remember: Penalties for incorrect VAT rate application can reach 200% of the tax amount. Investing in the right tools is not an expense, but insurance against potential losses.

Explore BuildHub AI

Test our tool and see how it can help manage your construction documentation.

Try a Demo →Related Articles

Peppol E-Invoicing Revolution in Belgium: Why 2026 Changes Everything for Construction Companies

From January 1, 2026, Peppol e-invoices are mandatory in Belgium. Learn the sys…

2026: E-Invoicing Revolution in Belgium and AI in Construction

Starting January 1, 2026, Belgian companies will only be able to send electroni…

AI in Construction 2025: Trend or Revolution?

AI is transforming construction: from smart cost estimates to automatic plannin…

Ready to optimize your construction business?

Join hundreds of construction companies using BuildHub AI